Whoa! I was poking around on-chain data and it hit me how messy visibility can be when you only skim dashboards. My instinct said something felt off about raw volume numbers that everyone cites. Initially I thought high trading volume meant real activity, but then I dug deeper and found wash trades and dust movements shifting metrics. Okay, so check this out—analytics on BNB Chain tell stories, but you have to learn the dialect.

Really? You're thinking every token chart is the truth. Hmm... not quite. On one hand, simple metrics help spot momentum, though actually transactions per address and unique active wallets often reveal the real health of a token. I started tracking a small BEP-20 project and noticed the liquidity was concentrated in a few addresses, which made price action volatile and misleading to casual viewers. That part bugs me because retail users get burned by superficial numbers all the time.

Here's the thing. Some DeFi dashboards look slick. They are very very attractive. Yet they hide nuance, like token vesting schedules, contract-owner privileges, and router approvals that can make a token dangerous. My gut said to check contract code and recent internal transactions before trusting volume spikes. So I wrote a checklist in my head—tx counts, holder distribution, router allowances, recent mints—then I actually applied it to two live tokens and saw different risk levels unfold.

Practical Signals I Use Every Day

Whoa! Small signals matter. For example, watch token holder concentration closely. If a handful of wallets control liquidity, that token is fragile. Observe approvals and allowance changes; sudden mass approvals to a new router are red flags. Also track contract creation and constructor parameters—sometimes owners hardcode admin privileges that let them pause or mint tokens.

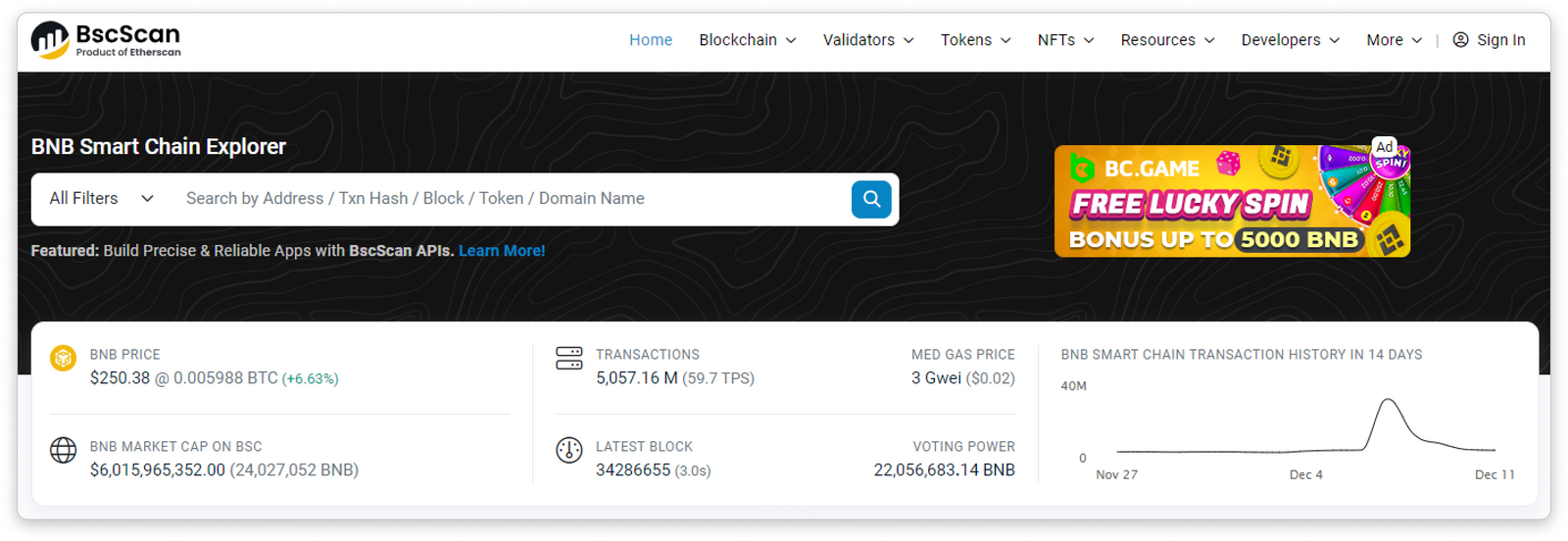

Seriously? Yes. I use on-chain explorers to trace token flows. The bscscan block explorer helped me map token movements from exchange addresses to cold wallets during a fork, which explained a price slip that on-chart indicators missed. Initially I thought on-chain tracing was cumbersome, but then I realized that combining address-tagging and transfer patterns gives you a narrative rather than just numbers. Actually, wait—let me rephrase that: chart overlay plus on-chain tracing equals better context for DeFi risk management.

Hmm... gas patterns tell a story too. Spikes in gas usage often precede contract upgrades or mass swaps. On one occasion I saw coordinated swap transactions with similar gas prices and timestamps, and that suggested a bot-driven liquidity skim. On the other hand, organic retail buys show varied gas and a broader timestamp spread. So timing patterns matter.

Okay, so check this out—liquidity pool analytics are crucial. Monitor the LP token holders and their stake durations. If liquidity is mostly in a freshly created LP with short-term stakers, expect flash dumps. Similarly, look at the ratio of locked vs unlocked liquidity. Lock contracts that are opaque or have short unlock windows are a worry. I'm biased, but I prefer projects that lock liquidity for long periods and publish clear vesting schedules.

Here's a quick workflow I use. First, open the token contract and read the source if it's verified. Second, scan transfers for large moves into unknown wallets. Third, check router approvals and staking contracts for unexpected privileges. Fourth, review on-chain holders and their balance decay over time. Repeat.

Wow! That sounds like a lot. It is a lot. But the reward is better signal-to-noise when evaluating BEP-20 projects. When DeFi yields look too good to be true, they usually are. My experience says yield anomalies often coincide with new contract deployments and immediate liquidity pulls.

On a technical note, watch for mint functions and owner-only supply adjustments. I once found a token with a hidden mint function only callable by a multisig that had a single active signer. Initially I missed that because the UI omitted owner activity, though internal txs showed repeated owner interactions. So check internal transactions as well as public transfers.

Here's the nuance—on-chain labels matter. When explorers tag addresses as "exchange" or "whale," it speeds triage. But label accuracy is imperfect. I've seen mislabeled addresses that led analysts astray. So cross-reference tags with transaction histories and known exchange deposit patterns. This is especially true for wrapped coins and peg tokens on BNB Chain.

Hmm... chain forks and bridge flows complicate analytics. Bridged assets bring in wrapped tokens whose liquidity can be suddenly affected by cross-chain congestion or bridge exploits. Keep an eye on inbound bridge transactions and large withdrawals. On one Friday evening a bridge delay caused a liquidity vacuum and price dislocations for several BEP-20 tokens.

I'm not 100% sure about every method, but heuristics help. For example, filter token transfers by gas price ranges to spot bots. Then cluster transactions by time and gas to identify potential MEV or sandwich activity. These patterns repeat, though the actors adapt continually. It becomes a cat-and-mouse game.

Here's what bugs me about shiny analytics suites: they often show aggregated metrics without provenance. You need provenance. Traceability to raw blocks and tx hashes matters when you want to prove what occurred. That's why I keep an on-chain notebook of suspicious wallet IDs and recurring router addresses.

Initially I focused on volume and market cap. Then I realized on-chain supply dynamics and holder engagement are stronger predictors for long-term resilience. Actually I corrected myself there—price momentum can persist regardless, but it exposes buyers when the underlying holder base is thin. On one token I watched, price jumped during a marketing push while holder count shrank, and when the push faded, sellers dominated.

Wow! Small community signals are undervalued. Look at social-wallet overlap and early holder growth. Organic growth shows a slow, steady increase in unique holders. Artificial growth often shows many transfers between clustered addresses. Also check for wash trading where the same addresses swap tokens back and forth to inflate numbers.

Common Questions from Traders and Builders

How do I spot rug pulls early?

Look for concentrated liquidity, owner privileges like minting or pausing, new routers with broad approvals, and sudden large approvals to unknown contracts. Combine holder distribution checks with internal transaction histories and recent constructor arguments. Use label data but cross-verify it by tracing actual transfer patterns.

Which metrics matter most on BNB Chain?

Unique active wallets, holder concentration, LP token distribution, recent mints or burns, and allowance changes. Also consider bridge inflows and outflows if the token is cross-chain. No single metric suffices; composite signals reduce false positives.

Tools you recommend for practical tracing?

Start with on-chain explorers and then layer address clustering tools and custom scripts for pattern detection. For quick triage I often use the bscscan block explorer to trace transfers and read verified contract code. From there I augment with local filters to spot gas and timing anomalies.

I'm biased toward hands-on verification rather than blind trust in dashboards. It takes extra time, sure, but it saves capital. Sometimes you catch subtle things that automation misses. Sometimes you don't. That uncertainty keeps me cautious.

So what's next for analytics on BNB Chain? Expect better labeling, more robust vetting of contracts when teams publish audits, and smarter heuristics to detect bot-driven metrics. On the flip side, adversaries will keep improving evasion techniques. On one hand the tools are getting better; on the other hand the game gets harder. I suppose that's the point—adapt or get left behind.

Here's the last thought: keep a healthy skepticism, read the code, and trust patterns more than single metrics. Oh, and by the way—save those suspicious tx hashes. They'll help you tell the story later, when someone asks why you passed on a hot token. Somethin' to file away, right?

评论